- Author: Shandel McAuliffe

- Posted: March 30, 2022

What’s the secret to managing subscriptions? A subscription asset register!

Managing subscriptions across an organisation can be challenging when each department has a plethora of tools they’re subscribed to. The trick is for the team responsible for spending to create an asset register. That team is finance. If finance uses an all-in-one spend management tool like DiviPay to capture payments across an organisation, they can create a subscription asset register.

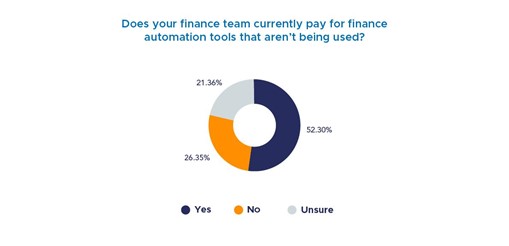

DiviPay asked 500+ CFOs whether their team pays for fintech they aren’t using – 52% of CFOs said yes, and 21% said they were unsure. That’s 73% of CFOs admitting that spending on tools – within their own department – is outside of their control!

If an organisation lacks visibility of their subscriptions, it can be like leaving a tap dripping in a closed-off back room. Vendors will happily charge subscriptions regardless of whether they’re being used. The onus is on the customer to monitor what’s being paid out to ensure the subscription is still needed, and that it’s the best solution for the business.

When a subscription tool, like DiviPay’s, is paired with a spending process requiring all subscriptions to be paid via the platform, CFOs and business leaders gain complete visibility of all subscriptions. This visibility forms the asset register. And with all subscriptions captured by DiviPay assigned to budget codes, finance can quickly ascertain what team is responsible for each subscription.

Once finance has visibility of all subscriptions, there are opportunities to spot cost savings. Perhaps two different departments subscribe to the one vendor – finance or procurement can investigate whether a better deal could be secured due to bulk buying, or even cancel a duplicate subscription if one can be shared across the business. And the obvious opportunity for cost saving is cancelling subscriptions that are no longer being used.

But cost savings aren’t the only benefit of a subscription asset register, businesses can also use the register to:

- Discover what subscriptions a team has, so access to a subscription/s can be managed for starters and leavers. Depending on the nature of the subscription, security around data access is a key concern that businesses need to stay on top of.

- Identify if there are subscriptions with organisations that the business does not wish to be associated with. Recent world events have shown how important it is for brands to be careful about who they do business with, and who they’re seen to support.

- Check a team has the resources it needs to do its job. For example, if marketing isn’t subscribed to martech automation tools, this is a good flag that the business might be under served in this area.

- Ensure department budgets are sufficient and being allocated correctly. For example, if finance can see that HR has spent a lot of money on publications, it can quickly raise this with the head of HR so funds are kept free for other activities if needed.

- Make sure subscriptions are actually being used. A quick email from finance to teams with active subscriptions each quarter, to remind them what they are paying for, keeps subscriptions front of mind.

A subscription asset register makes it easy to identify the subscriptions that are no longer needed. And when those subscriptions are linked to digital corporate cards, as is the case for DiviPay users, cancelling a payment for a subscription that is no longer active (to ensure incorrect payments aren’t deducted) is as easy as cancelling the digital card it’s attached to. As with blocking/cancelling a payment via a bank, the business/finance needs to first cancel the subscription with the vendor so the business isn’t liable for ongoing charges.

In ‘Automating Finance: Wins, challenges, and what’s next’, Soonah Walkom from Astute Administration Services explains:

‘A key part of my role is to help businesses look at their profits. Instead of this always being about increasing sales, I get them to think about expenses. And one of the big areas that we look at is subscriptions. It’s really easy now to just subscribe to lots of things. But it’s so important to revisit subscriptions on a regular basis because these expenses seem to jump quite high.’

A subscription asset register is just one facet of all-in-one spend management. Tools like DiviPay give finance and business leaders control over spend within their organisation, covering digital corporate cards, bill and subscription payments, reimbursements, and expense reporting. This type of comprehensive software drives costs down, while increasing insights and business intelligence.

To find out more about DiviPay, book your complimentary demonstration today.