- Author: Nina Hendy

- Posted: May 4, 2021

Whatever Floats Your Boat: CFOs Open Up About The IPO Process

By: Nina Hendy

IPOs are hot right now, putting CFOs under immense pressure. CFO Magazine’s Nina Hendy speaks with CFOs who have been through the process, how they coped and what they learnt…

The Australian Stock Exchange (ASX) is a flurry of initial public offering activity as companies strive to trade their way out of the global pandemic.

As Covid-19 spread to all corners of the world last year, CFOs made it a year to remember for different reasons – 2020 was the best year for the global Initial Public Offerings market since 2007.

Collectively, global IPOs were up 62 per cent year-on-year by capital raised – at $US333 billion – and up 21 per cent by the number of listings at 1,615, according to Dealogic.

It was a similar pattern in Australia. The number of new listings increased 23 per cent year-on-year to 113. The market value of new listings, including IPOs, spin-offs, direct and dual listings was up 148 per cent year-on-year at $35.7 billion, according to the ASX.

The IPO process falls squarely on the shoulders of CFOs, who have openly described an IPO listing process as arduous, complex and emotionally challenging. And it can drag on for months.

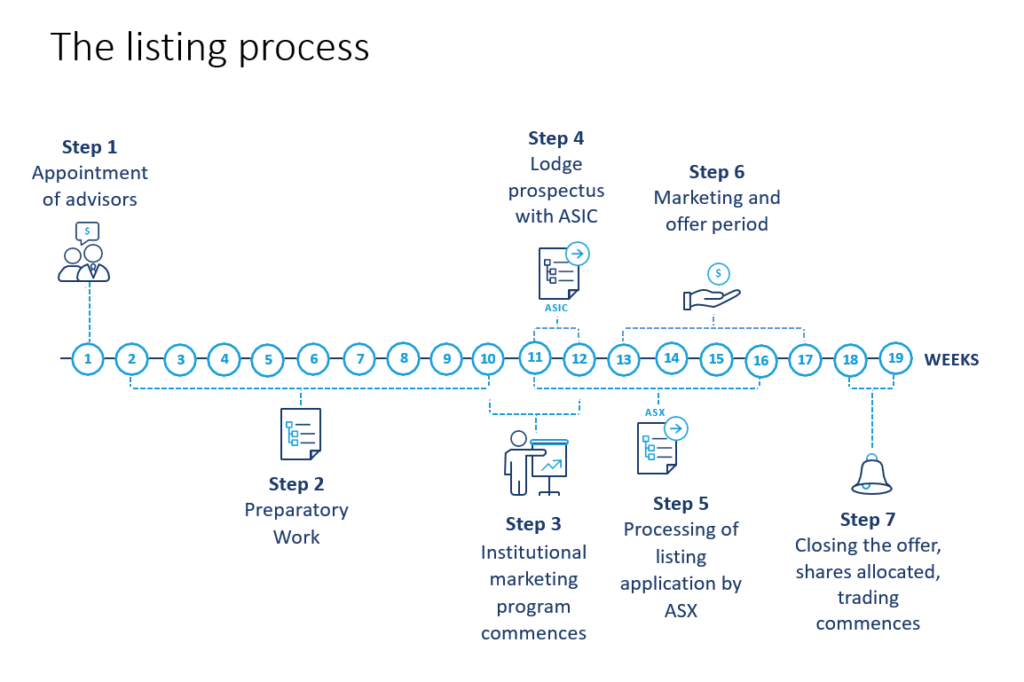

The ASX website outlines the IPO as a nine week process that involves drafting the prospectus, listing application and other documentation, followed by a due diligence process. In some cases, companies may also need to apply to the ASX for in-principle advice on the suitability of the company listing on the ASX.

But that doesn’t take into account the inordinate amount of work involved.

Recently listed company Airtasker (ASX: ART) completed the process in less than six months, but it wasn’t all beer and skittles.

The Australian gig economy jobs marketplace CEO Tim Fung told AFR Weekend that “Our CFO Nathan (Chadwick) was looking almost white. He said ‘Oh, that’s going to be right over Christmas.’

Chadwick’s fears were founded, with the interview revealing that due diligence meetings took place on Christmas Eve as the finance team missed festivities to prepare numbers for the prospectus. Airtasker fielded a last-minute call from ASX chief executive Dominic Stevens apologising for a human error that pushed the listing back a day.

Arduous and intensive

CFO James Frayne has just waded through an IPO process after online construction marketplace Felix (ASX: FLX) announced an intention to list at the height of the pandemic, in March last year.

“The business had an IPO on the radar for around two years, but there was great uncertainty in capital markets at the time we launched the process. I knew it was going to be a large undertaking.

“We all had some anxiety about the process that was occurring. I spoke to people in my network and they reaffirmed that it would be a lot of work. But they also filled me with great hope about life on the other side of the IPO,” he says.

Frayne described it as ‘a long and intensive process, unlike anything else he’d experienced’.

“Preparing for an IPO is essentially the same as working two jobs. You’ve got your normal job, and then the job of preparing for an IPO. You can’t wash your hands of the business, and you’ve also got to fully focus on the transaction, otherwise you won’t get the full benefit,”

James Frayne, CFO | Felix (ASX:FLX)

Frayne adds: “It’s never going to go exactly to plan. Curve balls are to be expected, and you need to be nimble to cope with these,” Frayne says.

James Solomons was ‘mopping up the mess’, joining online reference checking platform Xref (ASX: XF1) less that two weeks after the cash hit the account after going public.

Solomons took on the role after leading four institutional equity raises and a debt raise, and admits he was the first ‘qualified’ finance person to step into the role for Xref.

He not only had to focus on the now and future expenditure, Solomons also had to review the budgets and forecasts prepared as part of the IPO lead up, review the pro-forma financials that had been created and do his own sensitivity analysis across both sets of reports.

The IPO coincided with two international offices opening up, adding to the workload. “There’s nothing quite like being part of a fast-growth tech startup in the post-IPO period,” he says.

“It was very hands on, implementing formal policies and internal controls to cover operations in the finance office, as well as for the wider business, where there was an impact on the accounts. It was (and still is) an exciting time as the business now has the funds it needs to move on its global expansion plans,” Solomons says.

The business had already been operating as a private company for five years before going public, so had a rhythm in place that had allowed it to get to a point where it could do the IPO. “I bought in the governance and controls needed given that the business was now on the ASX,” Solomons says.

The ringing of the bell is an exciting time for any newly listed business. With the bank balance bolstered, everyone wants to move fast to execute all the ideas and plans that have been discussed prior to the IPO, he says.

“As a CFO, there’s an immediate sense of calm, knowing that your cash-flow runway is now much longer than I was a few weeks’ back. But at the same time, everyone is lining up for their allocation of funds that was scoped out as part of the IPO lead up. The sense of calm is short-lived,” Solomons says.

Lessons learned

Andrew Ritter has been involved in several IPOs over the years, both as an in-house CFO and as a consultant on two small cap ASX listings.

The IPO consultant, who trades under Pleiades Corporate Services, says the main lesson is that the time taken and ongoing commitment required is far more than anticipated.

How long the process takes often varies from entity to entity, but the process itself is generally consistent. “It often depends on how organised and prepared the company is prior to embarking on the IPO process,” Ritter says.

Key considerations include undertaking legal and financial due diligence, preparation of a prospectus, appointment of the chair, non-executive directors and a company secretary and undertaking investor roadshows to market for the capital raising, Ritter says.

One of the most important aspects of the IPO process is engaging a team of trusted advisors who are experienced in IPOs to guide you through the process, keep it on track and stick to the timetable,” Ritter says.

“Many companies (particularly smaller companies) tend to underestimate the staffing resources during the pre-listing phase and the associated costs of refocusing finance and management staff away from the day-to-day running of the business,” Ritter says.

That was certainly the case for Solomons, who admits that if he has time over again, he would have hired a second person to join the finance team during the post-IPO process.

“This would have obviously been an added cost, but an extra pair of hands to get through the multitude of tasks needed, on top of the day-to-day finance office tasks could have allowed us to run faster in many areas, which may have enabled us to better support the business as a whole in those exciting and very fast few months post-IPO,” Solomons says.

The benefit of hindsight

For the uninitiated, the process is a period of fundamental scrutiny and change, especially for young companies, shares Neale Java. “It’s important to proactively communicate to the team about where things are at at all times. Otherwise, uncertainty can creep in, making the company feel rudderless for a period of time.”

The CFO of tech company Control Bionics (ASX: CBL) has two IPOs and a pre-IPO under his belt, which he’s completed in the past 19 months. He’s seen IPOs run for a year and others that have been wrapped up in five months.

“People don’t realise how saturating the process is for the young leadership team. It’s all-encompassing. So many companies get paralysed after listing. Teams can sometimes lose all the momentum and fall into a state of paralysis,” he says.

“The process is very draining. It’s long nights and emotionally challenging. And a lot of companies think of the IPO as the destination, rather than it being day zero. The key is to maintain the momentum through the IPO process and out the other side,” he says.

“The key is to have on your board or within your leadership team individuals who have been through the process, clear decision making framework to enable the business to operate normally while the IPO process is ongoing and post-IPO management plan to ensure achievement of stated goals in the next 12 months,”

Neale Java, CFO Control Bionics (ASX:CBL)

Frayne admits that the most intensive and stressful aspect was the roadshow, which was conducted via Zoom due to the pandemic.

Five hours of back-to-back video conferences were not uncommon as you fielded various questions from funds, with 30 seconds in between each meeting, Frayne says.

“The CFO is asked very open questions and you get to take them on a very real journey, and you get very pointed questions. They just want a number. You feel like the white-hot lights are on you.

“It’s such a relief when you realise you’re getting bids for amounts well and truly over what you need, so you don’t have to worry about falling short. And while you’ve still got to go through the administrative steps of an ASX listing to go, but we knew the heavy lifting has been done,” Frayne says.

Staying the course

It’s important not to skimp on fees for advisors, and to appoint an experienced auditor, according to Rob Goss, who led digital audio networking technologies Audinate (ASX: AD8) through an IPO in six months.

“Completing an IPO isn’t the finish line, it’s a point in time. You’ve got to look past the ringing of the bell to understand how to grow the business into the future.”

Rob Goss, CFO | Audinate (ASX: AD8)

Goss admits that listing can be a risky time for CFOs. “A disproportionate number of CFOs leave their post six months after an IPO. Because the point of an IPO is only just the beginning of the journey. That’s when the real work begins.”

But if Frayne had his time over, the CFO at Felix reckons he would formulate his own strong narrative to be communicated throughout the process. “And I’d have a greater presence over that narrative from the start.”

And despite admitting it was a gruelling process, he’d do it all again. “I’d grab the opportunity to go through an IPO again with open arms,” he says.

7 Pieces of IPO Advice for CFOs:

- Build a strong team of advisors

- Understand that the experience is all-encompassing

- Don’t skimp of advisor fees

- Don’t be overly fixated on expense

- Know your numbers inside out

- Build your own narrative for the company from a CFO perspective

- Build out the processes for the company post-IPO – The IPO is the start of the journey, not the end.

Nina Hendy

Nina Hendy is a freelance Australian business and finance journalist writing for a range of media outlets including CFO Magazine A/NZ