- Author: Dr Paul Thambar

- Posted: February 15, 2021

Measuring Purpose & Value: The Mutual Value Measurement Framework

By Dr Paul Thambar | Monash Business School

Traditional accounting numbers and metrics don’t always tell the full story when it comes to relaying the value organisations are creating for all stakeholders. This is even more so for cooperatives and mutual enterprises (CMEs) because they carry out activities not just for revenues and profits but also to fulfil social purposes. CMEs are an example of purpose-driven organizations, seeking to measure their purpose and value.

Based on a two-year research study, I and colleagues1 developed a performance measurement framework specifically for CMEs that could help such organisations measure and communicate the value they created for members and the community in a consistent and holistic way.

Before we get to the framework, let’s take a deeper look at what challenges CMEs face in measuring and reporting their value creation.

The challenge at hand

Member-owned organisations, known as cooperatives and mutual enterprises, have a long and rich history. The first CME, Rochdale Cooperative, was established in the UK in 1844. Globally, one in every six people is a member of a CME with the world’s top 300 CMEs contributing annual revenues of $2 trillion in 2019, according to BCCM. In Australia, the first CME was established in 1859, and as of 2019, there were over 2,000 CMEs in Australia, with annual revenues of AUD 104 billion and over 31 million combined members (some Australians are members of multiple CMEs).

CMEs are distinctive in their long tradition of focusing on all stakeholders and having an inclusive corporate purpose. Credit unions and mutual banks, for example, were established to help communities borrow and deposit money and then carry out financial transactions.

However, CMEs do not have a framework capable of measuring fully the corporate purpose and the total value, i.e., mutual value they create for all stakeholders. Accounting rules and standards have been found to be incomplete in measuring this mutual value.

For instance, when an organisation invests in a start-up in a new market segment, it is creating value through shaping or building a market that is more than the initial funds invested. But this added value doesn’t typically show up in accounting transactions. But these types of “added value” transactions are significant for CMEs as they reflect their purpose.

According to a CEO of a large Australian CME in financial services, health and aged care, and health insurance, CMEs create community value through their operations but accounting practices and measures only measure a small part of this value.

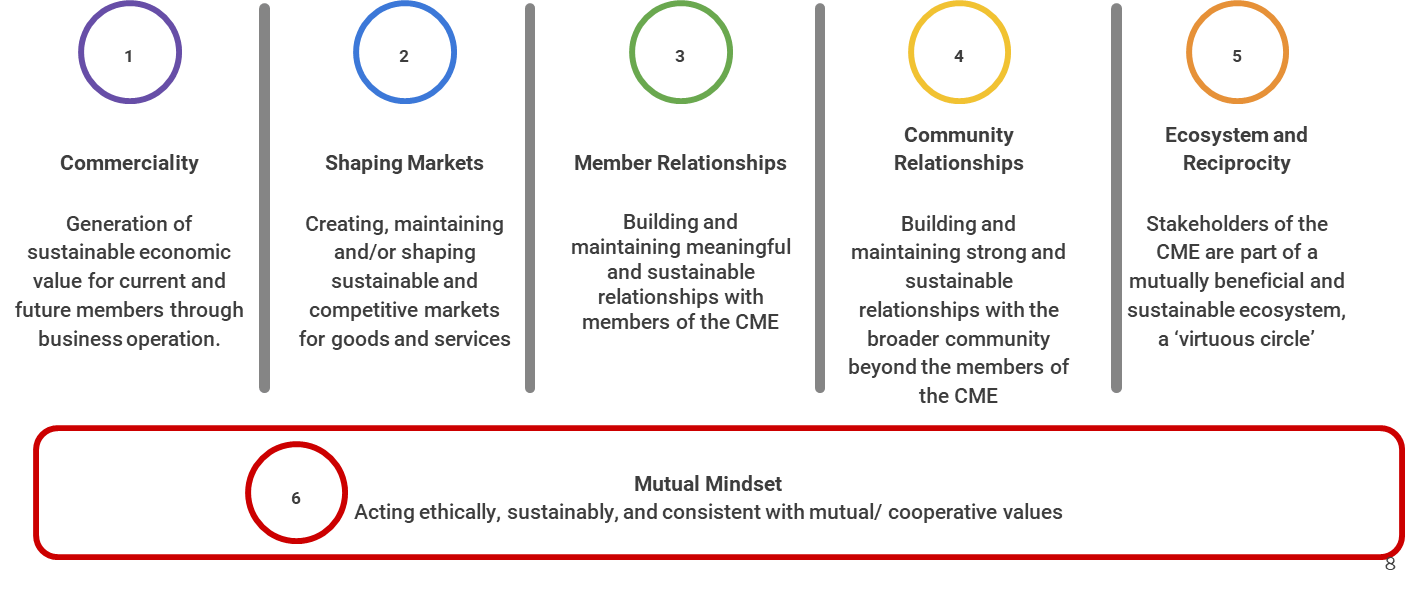

6 dimensions in the Mutual Value Measurement Framework

Our project led to the development of the Mutual Value Measurement (MVM) Framework (see the graphic, “Dimensions of Mutual Value”), which enables a CME to assess, measure, and report its mutual value resulting from its corporate purpose and value creation for all stakeholders. This approach can be used for other types of business such as listed firms, and organisations including charities and public-sector agencies.

The MVM framework was formally launched in 2019 with the framework promoted by the BCCM through its membership base. Around 35-40 CMEs have examined the framework in more detail and are in the process of adopting the framework as part of their performance measurement process.

The framework has six dimensions — commerciality, shaping markets, member relationships, community relationships, ecosystem and reciprocity, and mutual mindset — which our research revealed as key areas in which CMEs create value. Here’s a brief explanation of each dimension:

- Commerciality captures the economic value created by the business operations of the CME. This value can be measured using standard accounting measures such as net profit.

- Shaping markets captures the value from activities designed to create, shape, and maintain a market by the CME. An example is a credit union that provides banking and financial services to a regional community that would otherwise not receive such services because the market may not be economically viable for a major commercial bank. The value from this dimension might be measured using accounting and non-accounting measures.

- Member relationships is a dimension that captures value created for members over and beyond the value provided through the commerciality and shaping markets dimensions. This value is likely to be measured through non-accounting measures.

- Community relationships captures the value created by the CME for the community beyond members. This value can be measured using qualitative measures such as community engagement surveys.

- Ecosystem and reciprocity refers to the value created by the CME for its ecosystem of partners, eg, suppliers. Qualitative measures such as stories and testimonials can be used to capture the value created in this dimension.

- Mutual mindset refers to a dimension where a CME captures value created through a focus on long term decisions and ethical practices, and adherence to cooperative and mutual values. Mutual mindset, through the focus on values, also enables each of the other dimensions. Measurement of value in this dimension is carried out through the use of qualitative information such as stories and testimonials.

Dimensions of Mutual Value (developed by the project team)

Going beyond accounting numbers

Accountants are used to measurement with quantified accounting numbers and, increasingly, with non-accounting metrics. However, non-accounting metrics are used only if they can be “objectified” by quantification, as seen by how customer satisfaction surveys can be turned into a satisfaction index.

But our research found that some dimensions of mutual value cannot be measured by using only quantitative accounting and non-accounting metrics. Qualitative information such as stories and testimonials are required and are useful in measuring value. For example, measuring value in the mutual mindset dimension can only be effectively achieved by using stories and testimonials of decisions made that considered long- or short-term perspectives.

However, there’s reservation on using these to measure value created. In our interviews with managers in our case CMEs, we found that qualitative information was viewed as subjective, intangible, and messy to be used as performance measures. This view of qualitative information poses a challenge for performance measurement of purpose and value creation, and managers and organisations need to develop the skills and capabilities to overcome this challenge.

Current performance measurement practices focus on a single group of stakeholders, namely, shareholders, and use quantified metrics that do not fully capture the value and trade-offs that affect other stakeholders. The excessive emphasis on metrics may also prevent managers in business from taking a step back and thinking more carefully about what value is and how they create this value.

However, many leaders in the CME sector are aware of this challenge and welcome it. Measuring purpose and value for all stakeholders of a business is a challenging task and will require management accountants, CFOs and managers to go beyond current approaches to performance measurement. This framework provides an example of how purpose and value can be measured in holistic manner for all stakeholders.

1. The industry funded research study was carried out by Dr Paul Thambar, Prof Matthew Hall, Dr Yolande McNicoll (all from Monash Business School), Dr Sarah Adams (ANU) and Prof Yuval Millo (Warwick Business School, UK)

About the Author

Dr Paul Thambar is a senior lecturer with the department of accounting at Monash Business School in Melbourne. Prior to academia, Paul worked in senior finance and accounting roles in financial services and healthcare and in consulting. His research interests include the changing role of accountants as business partners, performance measurement, and the role of accounting information in commercial, not-for-profit and cooperative and mutual sectors