- Author: Vaughan Archer, Senior Director Analyst | Gartner

- Posted: July 4, 2024

Optimising Capital-Efficient Growth > A Strategic Approach for CFOs

Capital-efficient growth is key to navigating global labour shortage, higher rates and persistent input inflation, writes Vaughan Archer, Senior Director Analyst at Gartner for CFO Magazine A/NZ.

In today’s dynamic economic landscape, funding for new products and services is crucial for growth. However, unchecked proliferation of product and service lines can drive up costs and complexity, creating inefficiencies that hinder overall profitability. Persistent cost and capital macroeconomic issues have exacerbated this drag on profitability and require a new approach to portfolio management.

Gartner experts advise that heads of CFOs should assess their organization’s product or service portfolio through a return on invested capital (ROIC) lens to optimize capital-efficient growth. This approach not only streamlines operations but also aligns with investor preferences for capital-efficient profitable growth.

Key Findings and Recommendations

Recent Gartner findings indicate that CFOs in organizations with fewer, strategically targeted product and service lines deliver superior profitability and higher total shareholder returns compared to their industry peers. This finding is particularly relevant in today’s cost- and capital-constrained environment, where traditional portfolio management approaches—prevalent in 87% of organizations—fall short. These traditional methods tend to prioritize revenue or margin metrics over balance-sheet-oriented ROIC drivers such as fixed assets and working capital.

Moreover, the evolving investor landscape, characterized by a higher weighted average cost of capital, has further shifted preferences toward capital-efficient profitable growth. This shift underscores the need for CFOs to adopt more sophisticated and nuanced portfolio management strategies.

To drive efficient capital allocation and profitable growth, CFOs must adopt a multi-faceted approach. This involves nurturing strategically vital products and service lines, identifying opportunities for higher ROIC, and rectifying the root causes of ROIC erosion.

How to Ensure Long-Term, Capital-Efficient Growth

One of the primary responsibilities of today’s CFOs should be to ensure long-term, capital-efficient growth. This can be achieved by nurturing strategically vital products and service lines and protecting them from disinvestment. The first step is identifying such strategically important products and services.

A product or service line should be classified as strategically important if it meets two or more of the following criteria: it provides a material contribution to the organization’s core strategic objectives, is differentiated relative to the competition, is expected to contribute significantly to future scalable revenue growth, offers material synergies within the portfolio, or is core to brand identity.

CFOs should partner with their management committee or equivalent to undertake this assessment. This collaboration ensures that cross-functional perspectives are considered, leading to a more comprehensive evaluation. This activity should occur at least annually during strategic planning and be refreshed midyear during years when strategic refreshes occur. This ensures an updated consensus on strategically important products and services.

Products classified as strategically important must be insulated from product rationalization discussions. Limiting the portfolio to a maximum of 25% of strategically important products or services ensures that the portfolio is appropriately critiqued. This insulation allows CFOs to evaluate the remaining portfolio for rationalization or rehabilitation without the risk of inadvertently compromising critical drivers of long-term growth.

Identify Opportunities for Higher ROIC

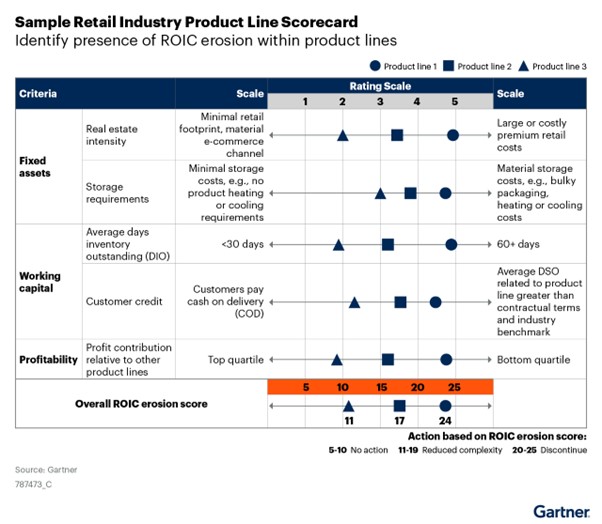

CFOs should develop an ROIC scorecard (see Figure 1) to identify which product and service lines are detrimental to ROIC. This scorecard should serve as a single source of truth, enabling a consistent approach to portfolio evaluation and rationalization. The scorecard should include assessment criteria that evaluate product or service lines against ROIC’s four key drivers: revenue/sales, costs/margin, working capital, and fixed assets.

After developing the scorecard, CFOs should task their finance business partners with evaluating the product or service portfolio against it. The availability of finance business partner resources, organization size, and number of SKUs will determine whether finance business partners are initially tasked with evaluating the portfolio at the product line or SKU level. In organizations with limited finance business partner bandwidth and an urgent need to realize ROIC improvements, senior leaders can delegate scorecard evaluation to divisional product managers.

Rectify ROIC Erosion

Once the portfolio has been evaluated, CFOs should use the results to guide portfolio management decisions. Product or service lines that score high (20-25) on the complexity scale should be discontinued. Those that score medium (11-19) should be reconfigured to reduce complexity, while those that score low (5-10) should be preserved.

After identifying product or service lines for rationalization, CFOs should take targeted actions to achieve breakthrough improvements in ROIC. Remedial tactics to reduce complexity include predictive maintenance, customer journey mapping, and staff cross-skilling.

Additionally, CFOs should partner with their CFO and investor relations counterparts to explore methods to extract value from product or service lines earmarked for discontinuation. These actions may include divestment strategies, such as trade sales and spinning off misaligned portfolios.

Conclusion

Amid a global labour shortage, persistent input inflation, and a growing capital market appetite for capital-efficient profitable growth, responsive product and service portfolio management has become a critical lever for financial performance management. Companies such as Coca-Cola and Procter & Gamble have successfully employed portfolio rationalization strategies, demonstrating the value of this approach.

CFOs must adopt the mindset of an activist investor, proactively engaging in product and service portfolio planning to shift capital away from existing lines that hinder capital-efficient growth. By following the outlined best practices, CFOs can ensure long-term growth, protect strategically important products and services from disinvestment, and drive efficient capital allocation.

This strategic approach will enable CFOs to optimize their portfolios, achieve breakthrough improvements in ROIC, and ultimately deliver superior profitability and higher total shareholder returns. In a world where capital efficiency is increasingly valued, adopting these practices will position organizations for sustained success and competitive advantage.

Author > Vaughan Archer, Senior Director Analyst | Gartner

Vaughan D Archer is a Senior Director, Analyst in Gartner’s Finance Practice. He has over a decade experience working with companies to design and implement strategies to improve their profitability and top line growth. He works with Gartner clients across the entirety of the efficient growth life cycle including, investment evaluation, budgeting, forecasting, cost management and benefits realization tracking.